INSR Smart Platform and Dynamic Risk Engine help you bring scalable insurance solutions to more clients, in more markets.

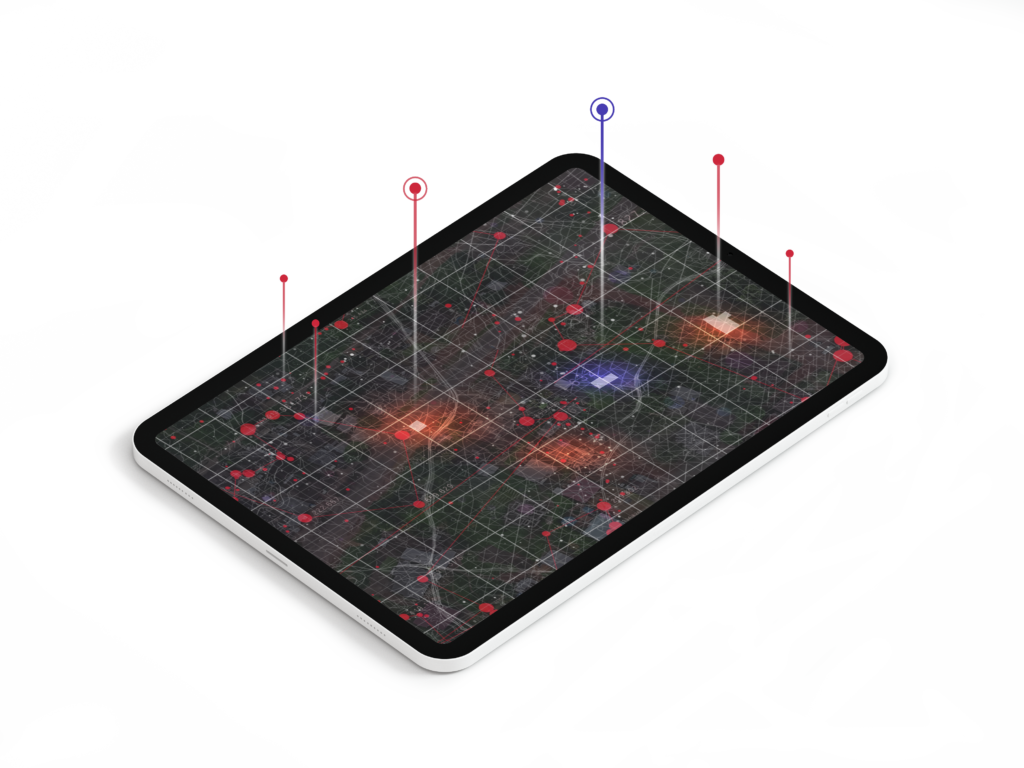

The INSR Dynamic Risk Engine (DRE) creates a dynamic Digital Twin that integrates multiple data sources (e.g. weather data, elevation, traffic, etc.) to generate a location-based risk score that reflects real-time context.

The INSR DRE acts as the pricing engine for all INSR insurance products. Working behind the scenes, it creates unique risk scores for each type of risk and looks at how the circumstances in surrounding cells influence that risk score updating it continuously.

Locations are linked to their unique digital node in our cell-based grid and are in constant communication with each other so that every insurance model is calibrated according to local parameters.

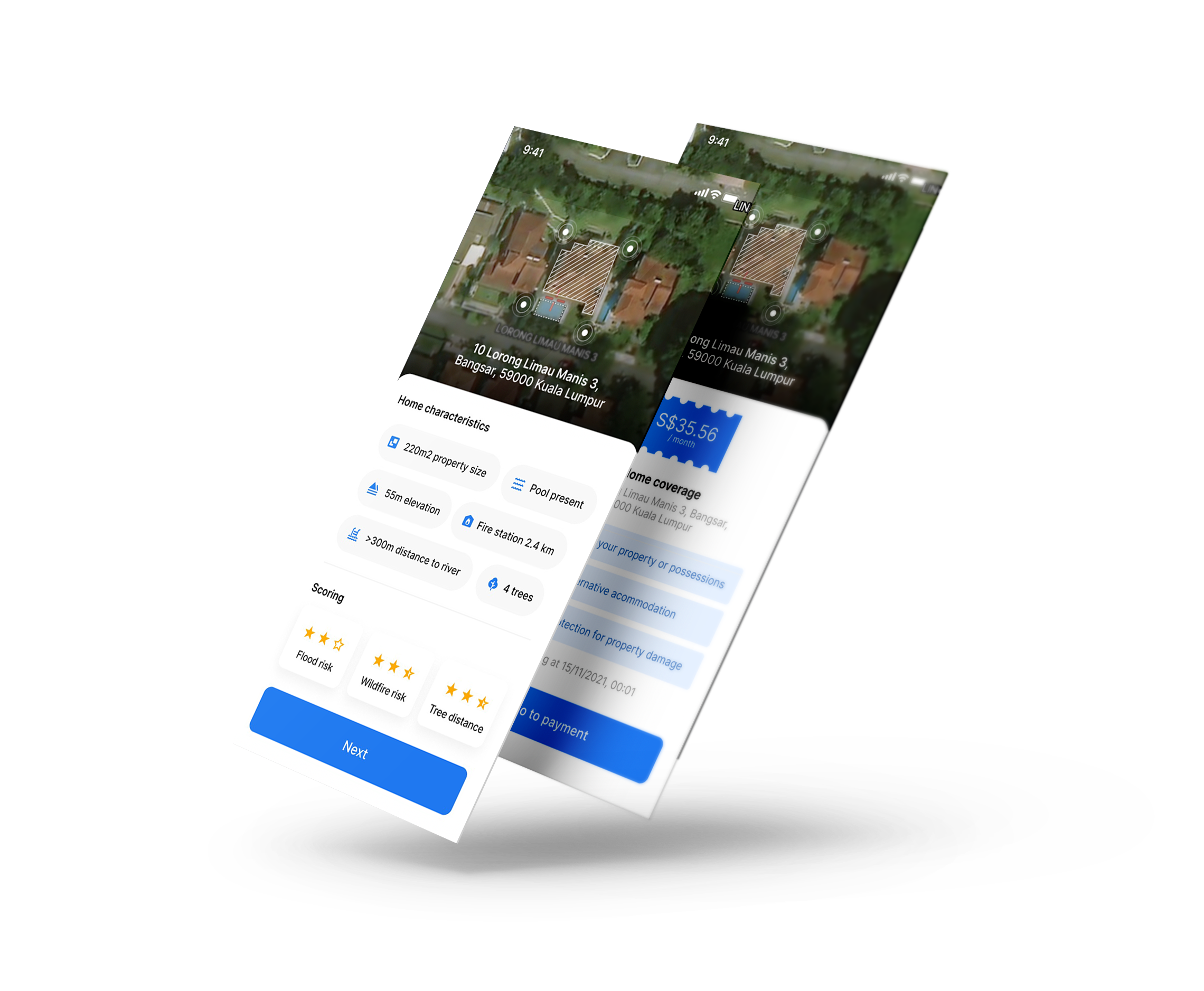

Our insurance models are able to include different data sources to measure geo-specific attributes (based on location, environment, and contextual specifics) for hyper-specific risk profiling.

Enabling the automated updating of premium particulars, coverage increases or decreases and the addition of new riders or assets to simplify insurance and offer flexible payments and coverage options.

72 Circular Road, #02-01,

Singapore (049426)

[Co. Registration UEN : 202116060E]